Introduction

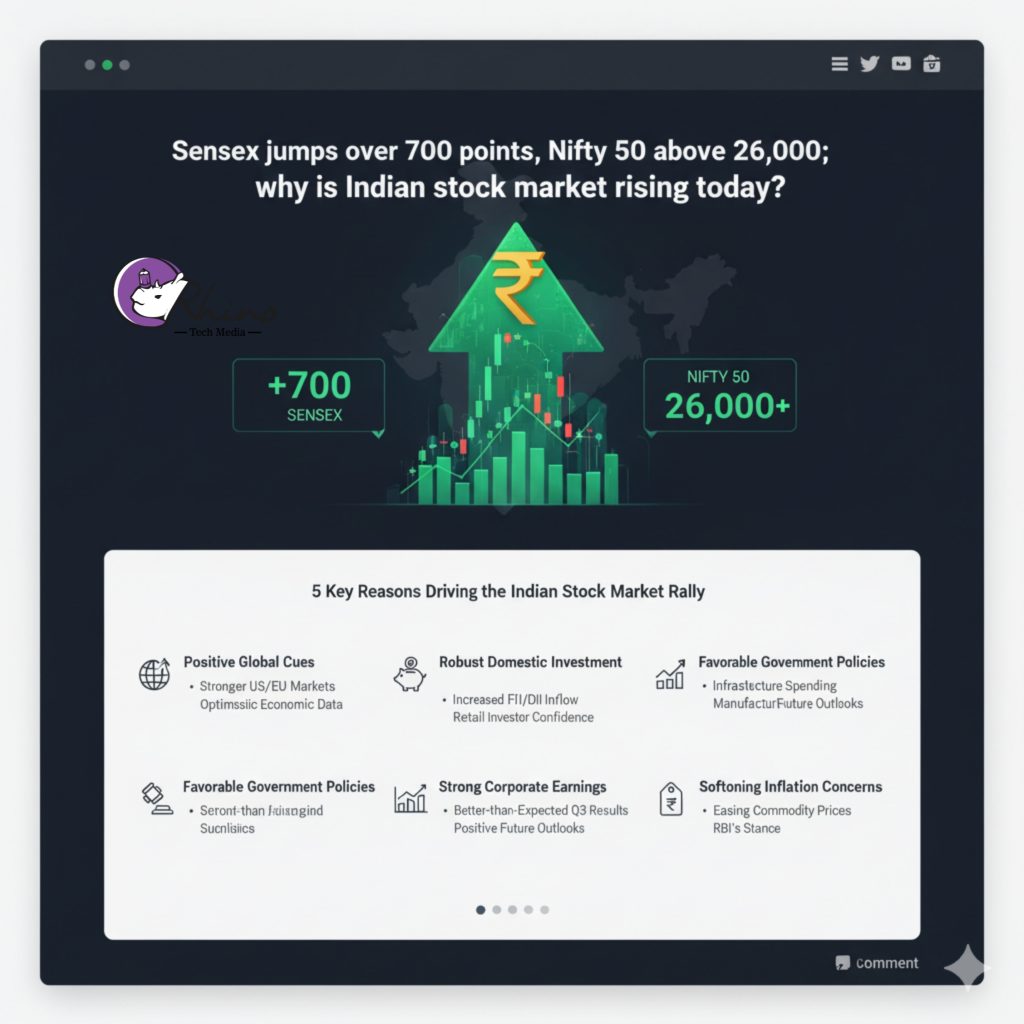

The Indian stock market is in high spirits: the Sensex has climbed more than 700 points, and the Nifty 50 has breached the 26,000 mark. Despite global headwinds, domestic equities are showing strength. The question is: what’s fuelling this upswing? Below are five major reasons — each interlocking to drive sentiment and flows into the market.

1. Optimism over a India–US trade deal

One of the biggest catalysts for the rally is growing hope that India and the United States are close to striking a trade agreement. Reports suggest that U.S. tariffs on certain Indian exports (currently as high as ~50%) could be pared down to around 15–16 %.

Such a deal would be significant for exporters, manufacturers and more broadly for India’s growth narrative. In addition, there is speculation that India may gradually reduce imports of Russian oil as part of the deal – which would align with U.S. strategic goals and further bolster the outlook.

In short: trade optimism is raising expectations of stronger corporate earnings, improved export demand and a favourable policy tailwind.

2. Strong corporate results and improving earnings trajectory

Another key driver: robust Q2 earnings from major companies. Heavy-weight firms such as Reliance Industries and large banks have reported results that have either met or exceeded expectations, helping to lift sentiment.

Analysts believe that the earnings bottom may be behind us, and that the second half of FY26 could see recovery. Forecasts for FY27 are pointing to ~15 % growth in earnings, driven by energy, banking and consumption-linked sectors.

Thus, as the earnings environment stabilises, investor risk appetite improves — and that’s helping push stocks higher across sectors.

3. Heavyweights and broad-based sectoral participation

The rally is not just confined to a couple of stocks — large cap companies are leading the advance, and multiple sectors are participating. Key names in IT, banking, metals, autos, FMCG are all showing gains.

When heavyweights move, index benchmarks like Sensex and Nifty rise, and investor confidence gets a shot of adrenaline. Moreover, the broad-based nature of the rally (beyond just one sector) reinforces the view that this is more than a fleeting move.

In essence: the big names are doing well, sectors are rallying coherently, and that is underpinning the index strength.

4. Foreign institutional investor (FII) inflows & short-covering dynamics

Money flows matter—and currently, foreign institutional investors (FIIs) are net buyers. Reports indicate the FII buying streak has extended across consecutive sessions.

In addition, there is a technical component: short-covering. Traders who had bet against the market (short positions) are being forced to cover as the market rises, which adds fuel to the upside.

Thus, positive flows + technical squeeze = added momentum for equities.

5. Technical momentum, improving currency and festive/seasonal tailwinds

Last but not least: a combination of technical, seasonal and macro tailwinds. On the currency front, the Indian rupee strengthened, which tends to encourage foreign investment and reflects improved risk sentiment.

Technically, the market is trading near upper bands, which invites more participation as momentum builds.

Also, the festival season in India is underway – historically a period of increased consumption and positive market sentiment. These seasonal factors add a behavioural overlay to the fundamental drivers.

In aggregate: the market has both fundamental and technical wind behind it, which is helping push it upward.

Conclusion

In sum: the Indian stock market’s rally today is underpinned by a powerful mix of trade-deal optimism (especially with the U.S.), improving earnings prospects, large-cap leadership and sectoral breadth, foreign inflows and short-covering, and favourable technical/seasonal conditions. While global markets may be weak, domestic factors are currently dominating.

That said, markets are never without risk: any disappointment in trade talks, earnings shortfall, or global shock could test this rally. For now, the mood is decidedly upbeat.